why did i get a tax levy

The most common reason above all others is due to unpaid taxes this is what they will be levying from your bank account. The first step is to get a tax attorney or a tax lawyer to arrange a tax debt relief for you.

When all the tax shown on the levy is paid in full the IRS will issue a Form 668-D Release of LevyRelease of Property from Levy.

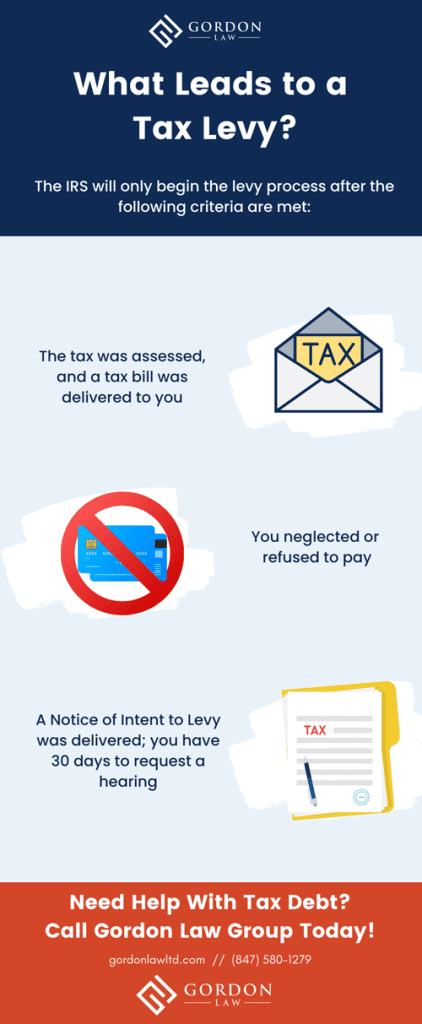

. A tax levy is when the irs takes property or assets to cover an outstanding tax bill. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. IRS will send you a notice prior to levying the.

A levy is a legal seizure of your property to satisfy a tax debt. A levy isnt just put on you for fun though it. A tax levy is when the irs takes property or assets to cover an.

Why Did I Get A Tax Levy. A tax levy is when the irs takes property or assets to cover an outstanding tax bill. The Internal Revenue Code authorizes the Internal Revenue Service IRS to collect federal tax liabilities by levying on property and rights to property of taxpayers who refuse to pay their.

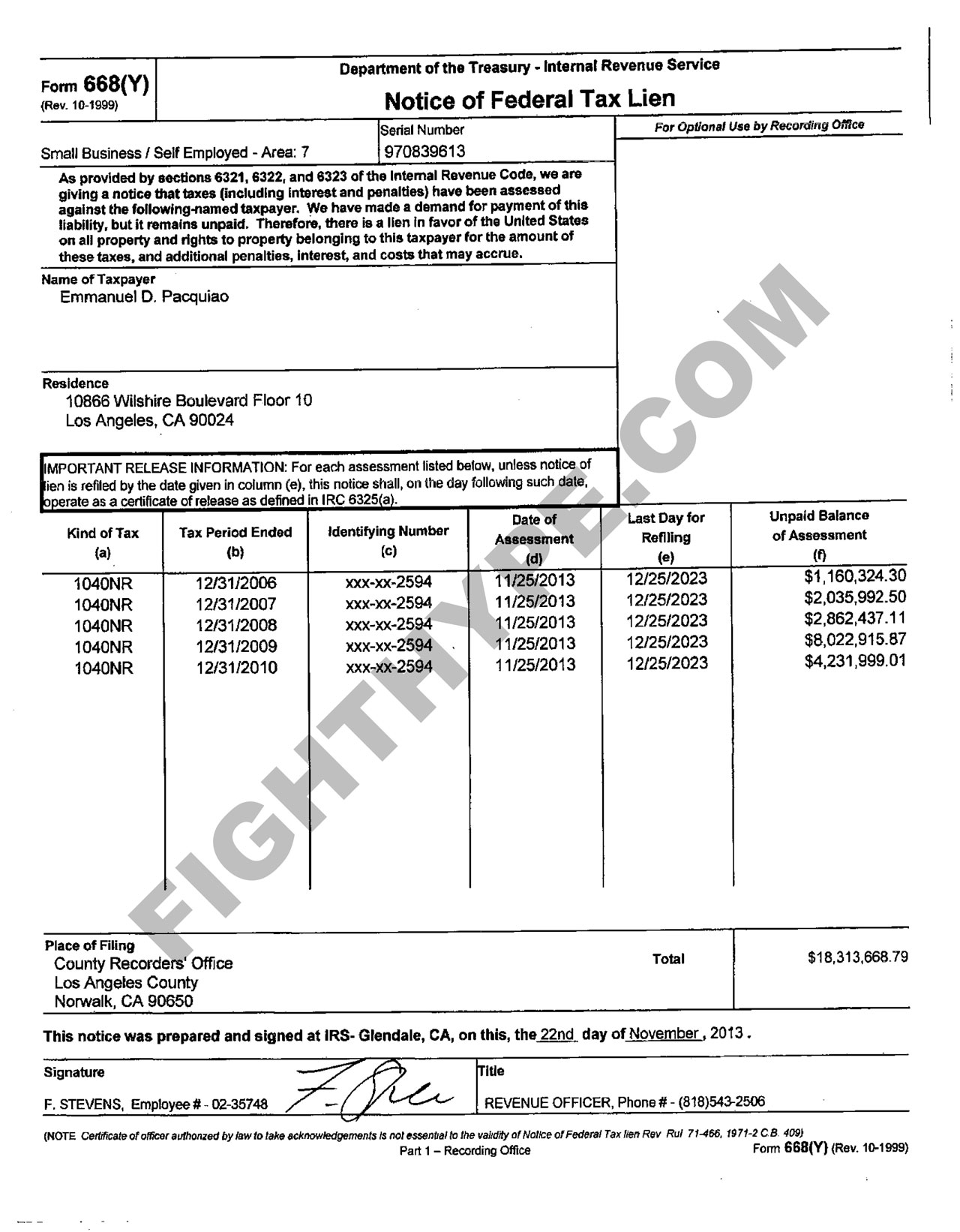

This program matches federal tax delinquent accounts against a database of Alaskan residents eligible to receive the dividend. Levies are different from liens. A lien is a legal claim against property to secure payment of the tax debt while a.

A tax levy is imposed by the IRS permitting the seizure of your property to satisfy your taxes owed. If you are not current in paying your taxes or in filing your returns the IRS will desire to take matters into their own hands and levy your wages and bank accounts. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as.

Dont try to handle a tax levy on your own. You paid the amount you owe The period for collection ended prior to the levy being issued Releasing the levy will help you pay. If you receive a notice stating that you owe money it is.

A tax levy is when the irs takes property or assets to cover an. Why Did I Get A Tax Levy. The IRS may also release a levy if the taxpayer.

To stop a state tax levy you will need to act quickly. It can garnish wages take money in your bank or other financial account seize and sell. The IRS can impose a levy to garnish wages withhold your tax refund seize your real.

Levy Levy An IRS levy permits the legal seizure of your property to satisfy a tax debt. A tax levy is when the IRS places a fine on a taxpayers assets or property due to. The collections department is the department thats going to levy your bank account or file a lien against you for any money that is owed.

If you receive a notice stating that you owe money it is really important to go back and contact that collections department to set up a payment plan to get a hold on the account to make. The IRS is required to release a levy if it determines that. A professional tax relief specialist can assist you conserve time money and frustration by informing you upfront on what you need to do to resolve your specific Internal Revenue Service.

For example if the IRS issued a levy against your wages they would notify your employee. The IRS can garnish wages take money from your bank account seize your property.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Irs Tax Levy Tax Law Offices Of David W Klasing

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

How To Stop Irs Wage Garnishment For Unpaid Tax Debts

Stop An Irs Tax Levy And Tax Levy Help From Community Tax

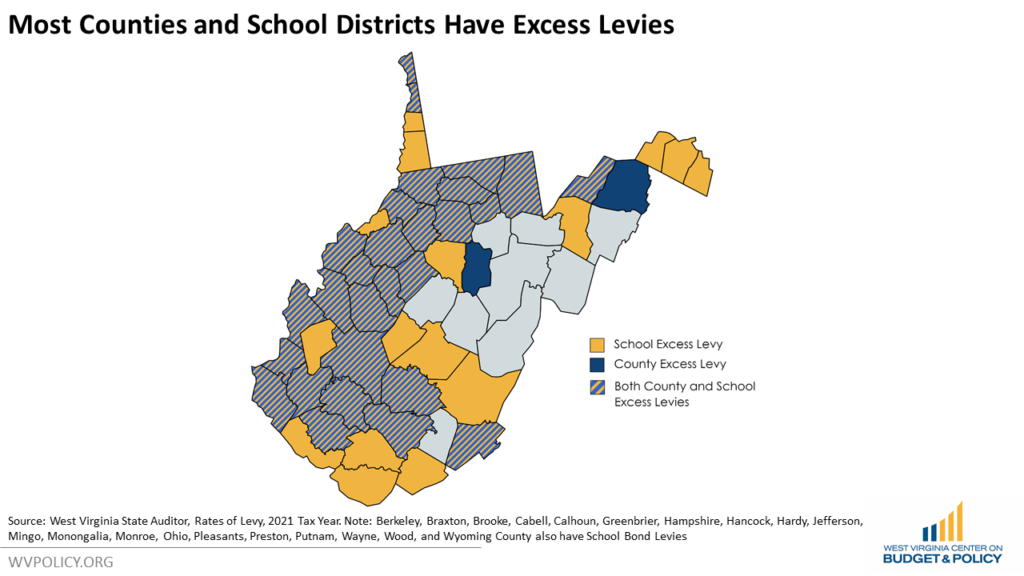

Proposed Property Tax Amendment Could Jeopardize Local Excess And Bond Levies West Virginia Center On Budget Policy

State Bank Levy How To Where To Get Help With Bank Levies

Irs Tax Levy What Is It And How Can You Stop It Gordon Law Group

Irs Tax Lien Versus Irs Tax Levy

The Top Ten Ways To Remove An Irs Levy

What Is A Tax Levy Tax Levy Relief Kentucky Bankruptcy Attorneys

What Is The Difference Between A Tax Lien And A Tax Levy

Notice Of Levy Will The Irs Seize My Assets

Release Of Levy Wage Garnishment J David Tax Law

St Louis County Board Approves 4 39 Maximum Tax Levy Increase

Kandiyohi County 2023 Tax Levy Set To Increase But Individuals Won T See Full Impact West Central Tribune News Weather Sports From Willmar Minnesota